How to sell or claim on old derelict house in the UK

In this article we will cover how you can sell or claim an old derelict house in the UK.

Sell your house in 28 days

WRITTEN BY: Tom Condon ★ Digital Content Writer

How to sell or claim on old derelict house in the UK

In this article we will cover how you can sell or claim an old derelict house in the UK.

Sell your house in 28 days

WRITTEN BY: Tom Condon ★ Digital Content Writer

Table of Contents

In the UK, over a quarter of a million properties are classed as derelict, with the North East exhibiting the highest number of derelict properties, indicating more than 1.4 unoccupied properties for every 100.

If you are looking to sell or claim an old derelict house in the UK, there are several important steps to keep in mind. Firstly, if you are looking to claim or sell an old derelict house in the UK, then you will need to evaluate the property’s value, consider its location, its state of disrepair and its potential for attractive renovation.

What is an old derelict house?

An old derelict property, also known as an abandoned property, is characterised by its prolonged period of vacancy or neglect. Since August 2022, homeowners have no legal obligation to uphold a specific standard of maintenance for their property.

Nonetheless, when a house is flagged as derelict because of issues such as broken windows or doors, roof damage, boarded-up entrances, or excessively overgrown outdoor spaces, the local council retains the authority to contact the owner. They can issue a request for necessary measures to be taken in order to ensure the property’s safety and habitability.

Why do properties become derelict?

Several factors contribute to the dereliction of properties. Frequently, derelict properties require extensive repairs or have structural issues that the owner lacks the financial resources to address, leading them to remain untouched for extended periods.

Various other circumstances contribute to properties becoming derelict, including insolvency or repossession proceedings, unfinished property developments, issues related to inherited properties and environmental problems such as contamination or subsidence.

What is a semi derelict property in the UK?

If you have ever taken the time to look down an auction house portal, you may have noticed properties that are labelled as ‘semi derelict’. Well, a semi derelict property refers to a building that is not entirely in a state of disrepair but exhibits significant signs of neglect and deterioration.

Semi derelict properties tend to have visible signs of wear and damage, including issues like a partially collapsed roof, broken windows, or some structural damage that impacts a building’s stability.

While they are not fully dilapidated, semi derelict properties require substantial renovation and repair work to restore them to habitable condition. They may still have salvageable elements or architectural features worth preserving, making them potential renovation projects for investors or buyers interested in restoring historic properties.

What’s the difference between abandoned and unoccupied houses?

An abandoned property is one that has been left inhabitable and in a state of disrepair for an extended period of time, whereas an unoccupied property is one that is still maintained by the owner but is not yet open.

When is a derelict house considered dangerous?

Derelict properties are considered dangerous when basic upkeep and protection from the elements are neglected, causing rapid deterioration. Instances where a property may be classified as a dangerous public health risk include:

- Severe structural issues due to a lack of maintenance.

- Unsafe conditions resulting from fire or storm damage.

- The presence of flammable materials or risk of explosions.

- Unstable walls or fencing susceptible to collapse.

- Unsafe flooring or non-weight bearing roof spaces.

- Poorly maintained roofs with potential for falling tiles.

- Unstable chimneys at risk of collapsing.

In cases where a property becomes hazardous following a natural disaster or fire, temporary precautions such as fencing, warning signs, or netting are often employed to prevent further risk.

Purchasing a derelict house requires a comprehensive assessment to identify potential hazards and determine the necessary measures to ensure safety before any further actions are taken.

Can I claim an abandoned house in the UK?

Yes, you can claim a derelict or abandoned house. Claiming an abandoned house allows individuals to become property owners without spending much money. But, claiming a derelict property is not as straightforward as it may seem.

Claiming an abandoned property can be daunting, but it can provide an opportunity to own a property that would otherwise be unavailable.

How do you spot an abandoned house in the UK?

To effectively identify an abandoned property in the UK, you should keep an eye out for properties with a neglected appearance, overgrown gardens, and broken or boarded-up windows. However there are other ways of confirming the abandonment status of a property:

- Check for unattended post: The accumulation of uncollected parcels and letters is a clear sign that the property may be derelict.

- Engage with neighbours: Speaking to neighbours can provide valuable insights into the history of the property. They might have information about the duration of the property being unoccupied and any past attempts to sell or rent it out.

- Consult HM Land Registry: Utilise the HM Land Registry website to access property ownership details. However, it’s essential to note that the absence of registration does not guarantee abandonment. Consulting a conveyancer can help delve deeper into the property’s history.

Contact the local council: Local councils often maintain records of abandoned properties within their jurisdiction. They can offer information on abandoned properties and their registration status.

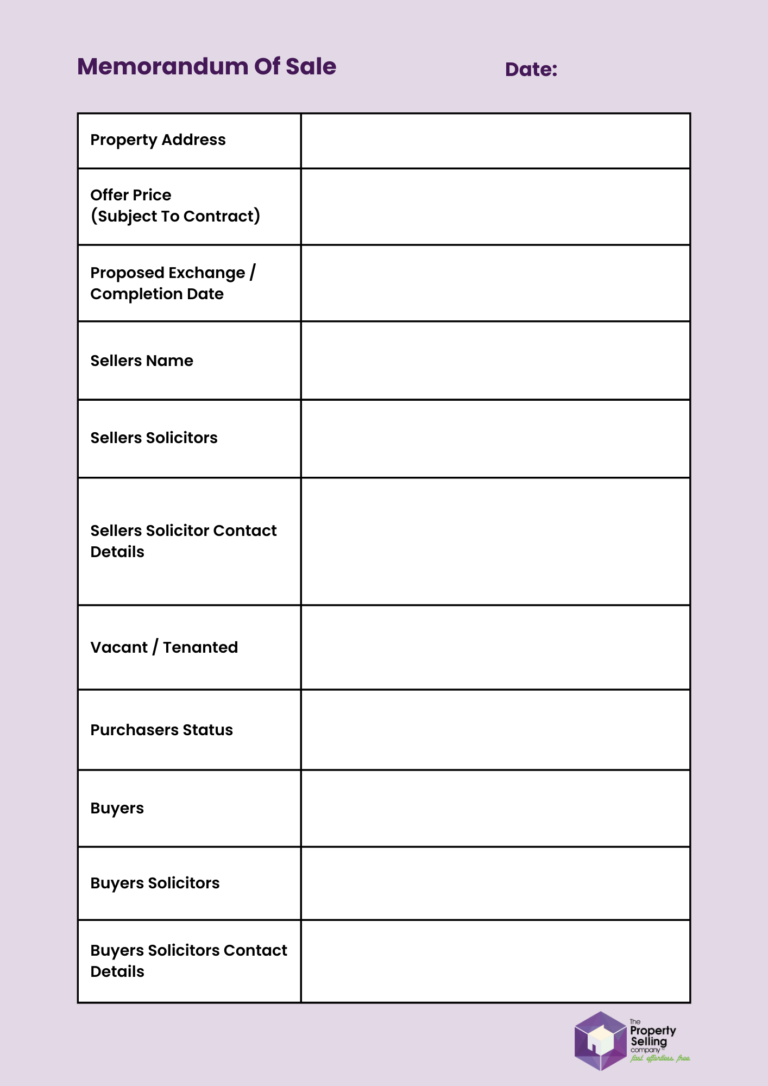

What is the conveyancing process for abandoned property?

Once you’ve identified an abandoned property you intend to claim, the conveyancing process can vary depending on its registration status. This is the conveyancing process for an abandoned property:

- Confirm property registration: If the property is registered with the HM Land Registry, your solicitor or conveyancer will obtain the title information, which includes the current owner’s details and any legal charges or mortgages on the property.

- Unregistered property conveyancing: In the case of an unregistered property, the conveyancing process shifts to Adverse Possession Law. This law allows an individual to claim ownership of land or property if they have been in possession of it for a specific period, and if the original landowner has not taken any legal action to regain possession. Adverse Possession may take anywhere from a few months or several years.

In order to claim an abandoned property by Adverse Possession, you will need to follow:

- Documenting possession: Your solicitor or conveyancer will assist in documenting the period of your possession of the property. This documentation is crucial to support your claim.

- Notice to the landowner: In some cases, the owner may be notified of the intention to claim adverse possession. This notification serves as a precautionary measure before initiating the claim.

- Time to wait: The landowner will be given a set period of time to respond to the notice, if they do not respond within the timeframe specified then you may continue with the claim.

- Application for Adverse Possession: Your conveyancer will guide you through the formal application process, which usually involves submitting an application to the Land Registry outline your claim and providing evidence of your continuous possession.

- Property registration: When the claim becomes successful, the property and land will be registered and registered to your name.

What are the risks when claiming abandoned properties?

There are many risks when claiming an abandoned or derelict house, the major one being that if the original landowner returns with proof that they are the owner, you will be unable to keep the property.

Furthermore, if you claim the property without the proper legal procedures and documentation then you may face legal action from the original landowner or local authorities.

Can you buy an abandoned property in the UK?

Yes, you are able to buy an abandoned property in the UK, but the process is not as straightforward as buying an occupied commercial or residential property.

Although the buying process can be similar to the traditional way to buy a property, there are a few things to consider when purchasing an abandoned or derelict property:

- You may need to obtain special permission in order to carry out renovations, extensions and demolitions of a house.

- You may be unable to carry out modifications or face tight restrictions if the property is a listed building or has historical significance.

- You may need to get an environmental survey completed before you can carry out any work.

- You will need to make sure that the property is habitable for residential and commercial tenants before it can be rented or leased.

- You may face a restrictive covenant in which landowners are prohibited from carrying out certain modifications of the property.

You will also need to ensure that when you are looking to buy an abandoned property, you check how long the property has been derelict for, if it is weather and watertight and if it is connected to utilities such as water, gas, sewerage and if there any restrictions on renovating or demolition.

What hazards are common within abandoned property?

Abandoned and derelict properties are have often become infested with several nuisances or hazards due to a lack of human presence, non-standard construction or human neglect:

- Pests like mice and rats.

- Bats.

- Squatters.

- Ground heave or subsidence.

- Asbestos or RAAC concrete.

- Unwanted leaks, dampness, rot and mould.

Can you insure a derelict house?

You will be able to insure a derelict property, but most home insurance providers will only cover an abandoned property for 30 or 60 consecutive days. If this is not enough, then you will be able to get a Specialist Unoccupied Property Insurance that will offer longer protection.

There will be conditions attached to either insurance policy, keep requirements for you to visit the property on a regular basis or keeping heating on at a minimum. If you do not plan on living within the derelict house or it is not habitable for a while, then you may consider researching different insurance covers.

How do you secure a derelict house?

If you become the proud permanent or temporary owner of a derelict house then you will need to protect it from both the weather, and from other humans. The potential issues from not securing your property may include vandalism, squatters, arson and theft.

Other than getting the proper insurance on your derelict property, you will need to secure it, which can be done by:

Ensure that the windows and doors have working locks, and that are locked when no one is in the property. If there are any broken entrances to the property, you may consider boarding the windows and doors.

Homes that look untouched for extended periods of time may become a target for burglars, which is why you should use timer switches to turn lights on so they illuminate at different times. This could also be done using smart lights and smart plugs which can be controlled by your phone.

You may want to ask for help from a neighbour to the property to keep an eye out on the property and report any suspicious behaviour to either you or the police.

If you are renovating your property, make sure that any tradespeople or yourself don’t leave tools within the property.

Having a security system with a good alarm and CCTV system can go a long way when securing a property. You could think about adding a smart CCTV home system installed which will give you notifications to your phone.

Older properties can have several outbuildings including stables, garages, sheds and barns. You should ensure that all of these are kept as secure as the rest of the property, as some criminals will use these as an entry into your property.

If there are any skips or bins on the property, make sure that they are cleared on a consistent basis. Excessive rubbish and litter will make your property a target for criminals.

Ask the post office to hold your post until the property is habitable, or alternatively redirect your post to your current address. Vandals and thieves will be on the lookout for property with excessive amounts of post.

Can you sell a derelict property?

Yes you can sell abandoned houses or derelict properties, but usually you might need to price it below market value due to the lack of renovations or modifications.

Fortunately, there are a few avenues available for selling derelict properties. These include leveraging auction houses, finding cash buyers or working with an estate agent experienced in dealing with abandoned properties.

Before listing the property, ensure it is safe and tidy to attract potential buyers. Making the building safe and addressing any outstanding liabilities or outstanding improvements is vital.

You may find suitable avenues in the UK housing market for the sale of derelict buildings or land for sale, including property auctions, privately owned portfolios, cash buyers and online estate agencies.

How do I sell my property in disrepair?

When your property is in disrepair and you prefer not to invest in renovations, there are still some strategies to sell your property.

In the case of a property that has fallen into disrepair, you should seek professional advice from a chartered surveyor or structural engineer who will be able to conduct a survey of the property and let you know if the property is habitable or not – this will open or close your house selling options.

One option is to be transparent about the property’s condition and highlight its potential for investors or buyers looking for a renovation project.

Additionally, you could explore selling the property as is, emphasising its location, land value, or planning permission for demolition, which could make it an attractive investment opportunity for property developers.

Alternatively, you could sell your property in disrepair to an online estate agent like us, who will be able to sell your property within 28 days. We work with a database of investors who will be able to either buy your property with cash, or be able to sell it on the open market at a more reasonable price.

How do I sell an empty property?

If you’re dealing with an unoccupied or empty property, the selling process can be relatively straightforward since there’s no need for anyone to leave the property. To streamline the sale, consider conducting a thorough survey of the property to identify any potential issues and disclose these to potential buyers upfront.

Additionally, you should ensure that the property is well-maintained, secure, and is attractive in order to significantly enhance its market appeal.

What’s the best way to sell a derelict house?

The best way to sell a derelict house is to sell with us! We are a leading UK online estate agency with over 50 years of combined experience in the house selling industry. We can sell your property in only 28 days, and help you achieve the highest house price available.

We’ll go above and beyond to get your property sold faster, all while you benefit from an improved, streamlined service away from the traditional estate agents. You will be in safe hands as we cover everything from floor plans, photographs, write-ups, viewings and your legal fees.

Sell your derelict house in 28 days