How Much Does an Annex Add to Your House Value?

Looking at whether a granny annexe can add value, advantages of self-contained living, and we can help sell your house with a self-contained living space.

Alexandra Ventress ★ Digital Content Writer

Table of Contents

There are many reasons why someone may decide to add an annexe to their property. From wanting to take in an elderly relative, or maybe to give their own children some independence, annexes are wonderfully versatile building addition.

But do they also add value to your property?

In this blog post, we will be looking at how much value an annexe can add, the different types of annexe accommodation, and what you as the homeowner will need to consider when planning to have one installed.

Looking for a quick answer? Check out our interactive menu, located on the left-hand side of the page!

What is a granny annexe?

An annexe, or granny annexe, is a stand-alone living space equipped with the ammenties needed for independent living. These include a bedroom, bathroom, kitchen and it must share the same address of the house it is a part of.

They are becoming an increasingly popular option in the face of rising care home fees, however, they are just as popular with elderly parents, as they are with young adults seeking a little bit of independence whilst still being close to home.

How much value does an annex add to a house?

It is estimated that a self-contained unit can increase home value by 20-30%. However, exactly how much value adding an annexe to a house will bring will depend upon a variety of factors, such as the layout of the annexe, its size, and the features that it has inside.

Due to the rising cost of living costs and property prices, annexes are becoming an increasingly popular choice, as they allow buyers to have a separate space for their children to live in or older family members.

Does an annexe increase council tax?

If your separate living space is located within your home, then you should not have to pay any further council tax. If your annexe is unpopulated, then the same will apply. However, if your annexe is a self-contained living space separate to your main property and is occupied, then the rules around paying council tax become a little harder to understand.

You will be exempt from paying council tax if you have a dependent relative living in your annexe or granny flat. A dependent relative is classed as someone who is over the age of 65 or is permanently disabled or mentally impaired. If you are renting your granny annexe to a non-dependent relative, then you may still be able to qualify for a 50% discount.

In order to fully understand the rules and regulations surrounding council tax and your additional living space, it is a wise idea to get in touch with your local authority.

How much does it cost to build an annex in the UK?

According to Checkatrade, you can expect to pay an average of £90,000. This is alongside factoring in the costs for building regulations, planning permissions, and other aspects of the building process. Whilst the average cost is £90,000 but can cost anywhere between £80,000-£10,000.

Types of annexes available

When it comes to building an annexe, there are many different types available. Below, we take a look at the four most common types of annexe that you are likely to come across:

A granny flat typically occupies one floor in a family home. Often found in cities, these are self-contained flats.

If you have an outhouse on your property that is not being used, then you have the potential to convert it into an annexe. Also referred to as a garden annexe.

A traditional granny annexe is inside the main property or is added as an extension.

A prefabricated annexe comes with all of the fixtures and fittings and is assembled onsite. A prefabricated annexe costs an average of £40,675 to assemble.

How big can you build an annex without planning permission?

If you do not wish to get planning permission for your annexe, then you will need to be sure that your annexe complies with the rules under the Caravan Act. The Caravan Act dictates that annexes must meet the following requirements:

- The building should be no longer than 20m

- The height of the building should be no taller than 3.05m

- The width of the building should be no wider than 6.8m

The use of the annexe will also need to be incidental to that of the main house. This means you will be unable to put it up for sale separately from the main house.

You will also need to obtain a Lawful Development Certificater from your local authority to confirm that the annexe can be deemed as incidental.

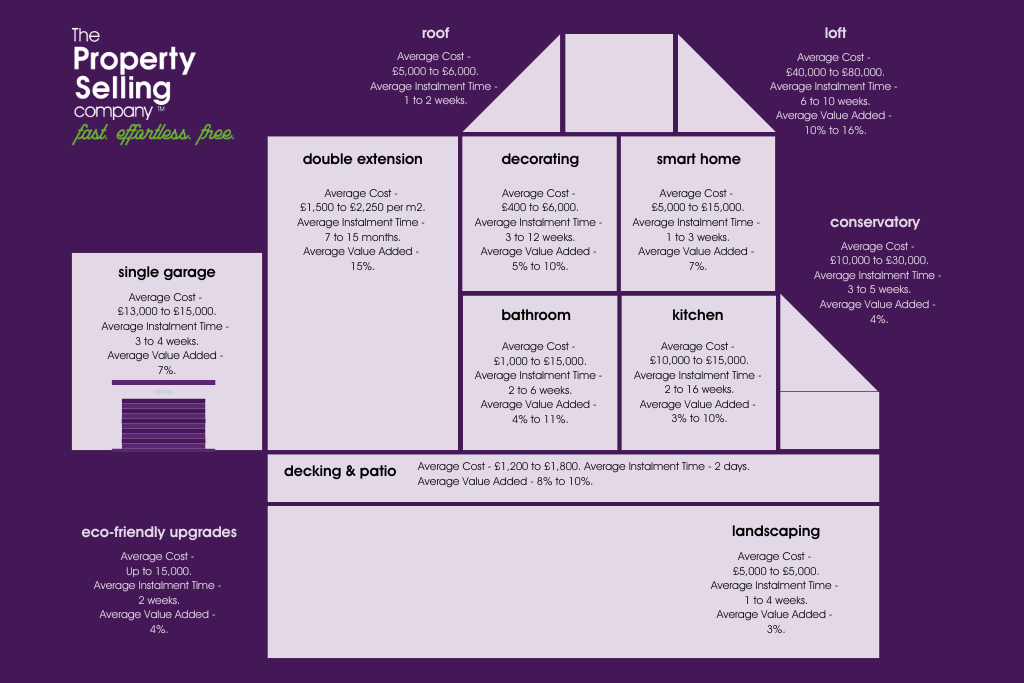

What adds the most value to a property?

Whilst adding an annex to a house can add up to 30% value onto your property, you may find yourself wondering what are the other things that add value to your home? Below we are going to look at how to add value to your home with various other remodelling, renovations, and upgrades:

1. Off-street parking

According to data from Zoopla, off-street parking can add a staggering £50,000 to your property’s value. Off-street parking has the potential to add the most value to houses in busy city locations, however rural and suburban areas also value this home improvement.

Exactly how much converting a garden into a parking space will cost will depend upon a variety of factors, such as the cost of reinforcing the pavement, dropping the kerb and making changes to the garden.

2. New kitchen

Whilst a kitchen conversation is a great way to add value to the property, you will need to make big changes in order to reap the benefits properly. Unfortunately, simply replacing cabinets and repainting the walls won’t cut it and you will end up spending more than you gain in value.

To add the maximum amount of value to an outdated or small kitchen, you will need to look into creating a good layout, which means potentially extending.

If you are looking at getting a full kitchen redesign in order to properly maximise the value added, you could find yourself looking at a bill of around £45,000. However, a new kitchen is thought to add about 15% value to your property, so it is worth giving some thought to.

3. Open-plan living

Open plan living is another renovation you can do to your home to help increase home value by 3-5% . Large multi-functional spaces are becoming increasingly popular, especially with families, as it allows parents to keep an eye on young children when entertaining or just going through everyday life.

However, with the cost of living crisis, some buyers are being put off open-plan living, as it costs more to hear.

Whilst it is fairly simple to knock through a wall to create an open living plan, you should be wary that this project can turn expensive if the wall you are looking at knocking through is a load-bearing wall.

4. Loft conversion

A great way to add value to a house is to invest in a loft conversion. A great choice for city properties, loft conversions are great for those with limited floor space, and can add up to 15% on to your properties value.

Depending on the work you plan to carry out, you may not need planning permission. If you are planning on converting up to 50 cubic metres of loft space, then you will not need planning permission. However, if your plan for the conversion exceeds limits and conditions, then you will need to seek planning permission.

You can expect to spend an average of £22,000 on a loft conversion.

5. Garage conversion

A garage conversion can add up to 15% value to your property. Whilst an extra room may serve you well, you will need to consider whether future buyers may value a garage over it. If you have a home in a city, then a garage may be invaluable, as parking can be difficult to come by.

However, an extra room can be very useful to some buyers, as it can make an extra bedroom, home office, home gym, or extra bedroom.

Whilst you may not need planning permission, you will need to pay for an inspection to ensure that the conversion meets building regulations.

For a standard garage conversion, you can expect to pay anywhere between £5,000 and £7,000.

6. Basement conversion

Creating space beneath your home in the form of a cellar or a basement can be a great way to add between 10-15% and is a great choice for city properties.

It is also a great choice for older properties as buyers can often feel as though as cellar fits with the period the home was originally built in.

7. New bathroom

A good, low-value way to add value to your property is to convert your tired-looking bathroom. However, in order for a new bathroom to truly add value to your home, the rest of your property will need to look equally as smart.

If you want to fully gut your bathroom, you should prepare for extra spending as changing the layout of your bathroom, as well as pipes and plumbing, can be expensive.

However, if you want to simply replace your toilet, shower, bath, or sink, you can make a huge change to your bathroom without going over budget. Retiling your bathroom is an inexpensive task, as is adding new lighting.

These simple changes can help add between 3-5% value to your property.

Where can I sell a house with an annex

Looking to sell your house with an annexe? Then we are here to help!

Here at The Property Selling Company, we believe that every house sale should be three things: fast, effortless, and free.

That’s why we have made it our mission to change the way that you sell houses. Say goodbye to the days of expensive legal and estate agent bills, as we can sell your home in as little as 28 days, without the fees.

We offer you a full online estate agent service, without the hassle. This means we take care of everything and work alongside you throughout every step of the house-selling process.

If you’re ready to kickstart your house-selling journey today, then get in touch today and fill in one of our free, no-obligation form to get your house valuation!